Daytona attorney Heidi S. Webb debunks 6 myths about starting a small business.

As a small business attorney here in Daytona Beach, I’ve heard it all from hopeful entrepreneurs. I’ve come to learn that there are two breeds of people that see a business venture on the horizon, yet have it all wrong when it comes to what it takes and what to expect when starting a small business.

There’s the Pollyanna, dreamer type who jumps right in – without much thought or quite enough preparation in place, thinking it’s all going to be gravy. And then there’s the over-thinker, glass half-empty individuals who could have a great thing going but are too intimidated, overly apprehensive, or just uninformed about what it will take to start a venture of their own.

For these two types, I’ve debunked some common myths to knock some sense into those that have misconceptions about starting a small business:

Debunking Myths About Starting a Small Business (For the Pollyanna-Type Entrepreneur)

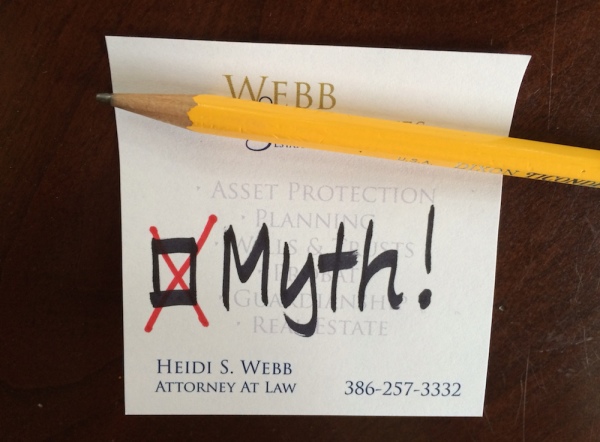

Myth 1:

“I’ll have more time for myself / with family / to do what I want.”

Starting your own business is an incredible dream that I think more people should consider. However, some forget that owning your own business is not always going to be a walk in the park. Yes, you get to make your own schedule. But your schedule doesn’t stop with your appointment book, and you’re never truly “off the clock” when the computer shuts off or the Open sign gets turned over. Your brain and to-do list will be brimming day and night, and that’s why when starting your own business you must have an unwavering passion and energy for what you do. As they say, if you love what you do, you’ll never have to work a day in your life.

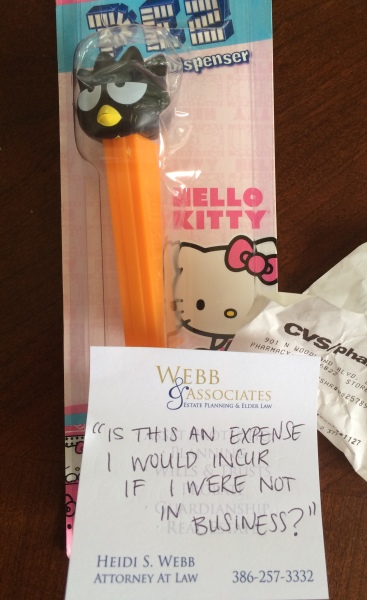

Myth 2:

“I can write everything off.”

Not true. Yes, you can certainly count on being about to write off some of the business expenses you incur while starting or owning and operating your own company – but remember that even though it’s a small business, you still stand the chance of getting audited (and that’s no joke). Entrepreneur gives the advice of Philip C. Roventini, a New York City-based CPA with more than 25 years of experience working with small-business owners:

“You can easily identify a real business expense vs. what isn’t by asking yourself this question: ‘Is this an expense I would incur if I were not in business?'”

For example, you can’t just save random receipts thinking you’ll be able to write off all of those equally-random expenses you’ve had over the year…

The IRS would not be pleased with this one… Fear the audit!

Myth 3:

“I don’t need a business plan, and there’s no need for a contract (we’re all friends, right?).”

Having the right plan and the right documents in place–with the help of the right experts–is essential to any business, whether you work alone or for yourself as an LLC or whether you plan on taking employees or hiring a friend, family member (or anyone at all) to work under you. You must take the time to consult a business attorney, no matter what the make-up of your company is like, but this is especially the case if you’re starting a small business as a partnership. Consulting someone in the field of business law will pay off; you’ll have templates to use at later dates for contracts and other transactions that may take you a lot of time and thought otherwise. You have enough to do, and you shouldn’t risk doing some of these things on your own, anyway. To learn more about types of businesses click the link.

Debunking Myths About Starting a Small Business (For the Nervous Nelly Entrepreneur):

Myth 4:

“I wish I could make a living doing this, but it costs a lot of money to start a business.”

For most cases, starting your own company is actually very simple and not at all expensive. In Florida you can literally just log on to sunbiz.org and start a business the very same day. I believe the cost adds up to about $125-$150 to file, but don’t quote me. Do your research on the website. Of course, depending on the business you’re starting, you may have more to consider than just a filing fee and some new software to get you going.

Myth 5:

“I have a product/service/set of skills in demand, but I’m not experienced with numbers/marketing/keeping up with files/accounts (administration).”

A lot of people have something great to offer, yet they’re intimidated by the prospect of starting, owning, or operating a small business. Rest-assured that there are many resources and professionals out there that can help. Old dogs can indeed learn new tricks, and if you can’t do some research/self learning, track down a mentor, or take a class to learn the business skills you need to make it – remember that you can outsource or delegate these tasks or duties to a professional that can accomplish them properly. Look to business attorneys and accountants for help with contracts and numbers, and check out the free resources available to entrepreneurs both online and in your community. In Daytona Beach SCORE is a great resource, check out my blog on essential steps to small business success to learn more about them.

Myth 6:

“I can’t start a business until I am able to quit my current job.”

You can start a business at anytime without going gung-ho or doing everything all at once. Many people have gone on to own and operate successful small businesses that they’ve started while working at another occupation. Many solo entrepreneurs even use there small business as a second source of income. Whether you’re selling your homemade jams and jellies or initiating the next great tech start-up, you can indeed begin and go at your own pace. Every little bit counts.

Starting a Small Business, Living the American Dream

Starting a small business is never quite as easy or as hard as most people think it is. Working as a lawyer in Business Law, I see these two polar opposite views from would-be entrepreneurs all the time. The best advice I can give is do your research and consult professionals like business attorneys, accountants, professional marketers, and business consultants in order to have the best results and the best experience with your small business dreams. Good luck!

About Heidi S. Webb, Attorney at Law: Heidi Webb has nearly two decades of experience working as an attorney in the areas of small business and commercial law, elder law, estate planning, probate, wills, trusts, and medicaid planning for long term care. She works in the historic Kress building in Daytona Beach; and in addition to being an attorney at her own private practice, she has started a variety of successful small businesses – including managing office space at Work Webb in Daytona Beach, planning events and cooking up delights for Gourmet Girls, and making drinks unique and great tasting with her Not So Simple Syrup line.

About Heidi S. Webb, Attorney at Law: Heidi Webb has nearly two decades of experience working as an attorney in the areas of small business and commercial law, elder law, estate planning, probate, wills, trusts, and medicaid planning for long term care. She works in the historic Kress building in Daytona Beach; and in addition to being an attorney at her own private practice, she has started a variety of successful small businesses – including managing office space at Work Webb in Daytona Beach, planning events and cooking up delights for Gourmet Girls, and making drinks unique and great tasting with her Not So Simple Syrup line.

Contact Heidi at (386) 257-3332 for a free consultation, and don’t forget to ‘Like’ Heidi Webb, Attorney at Law on Facebook for worthwhile updates, sprinkled with tips and free advice on estate planning and small business.